# Loan

# I. Creating a Loan Account

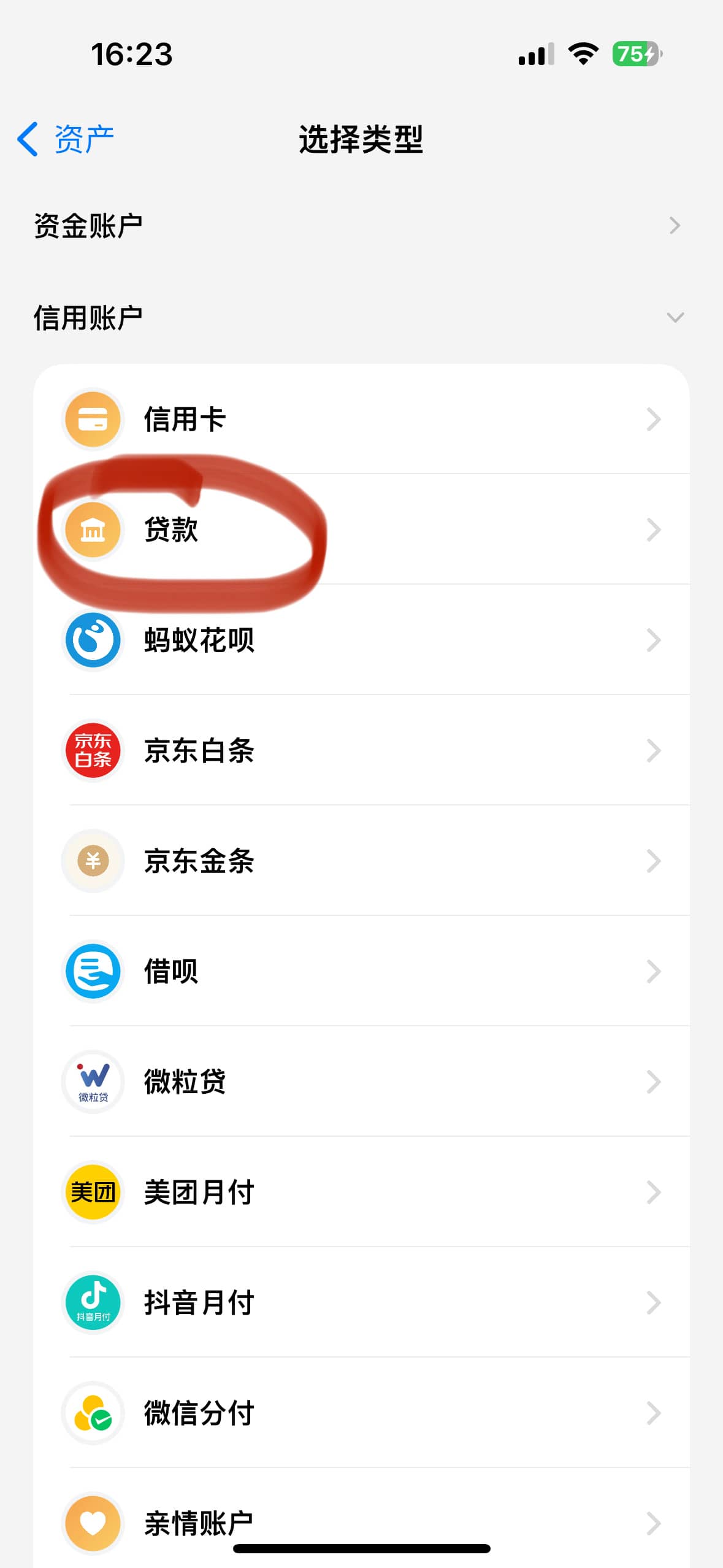

In the new asset section, choose to create a loan account.

# Parameter Explanation:

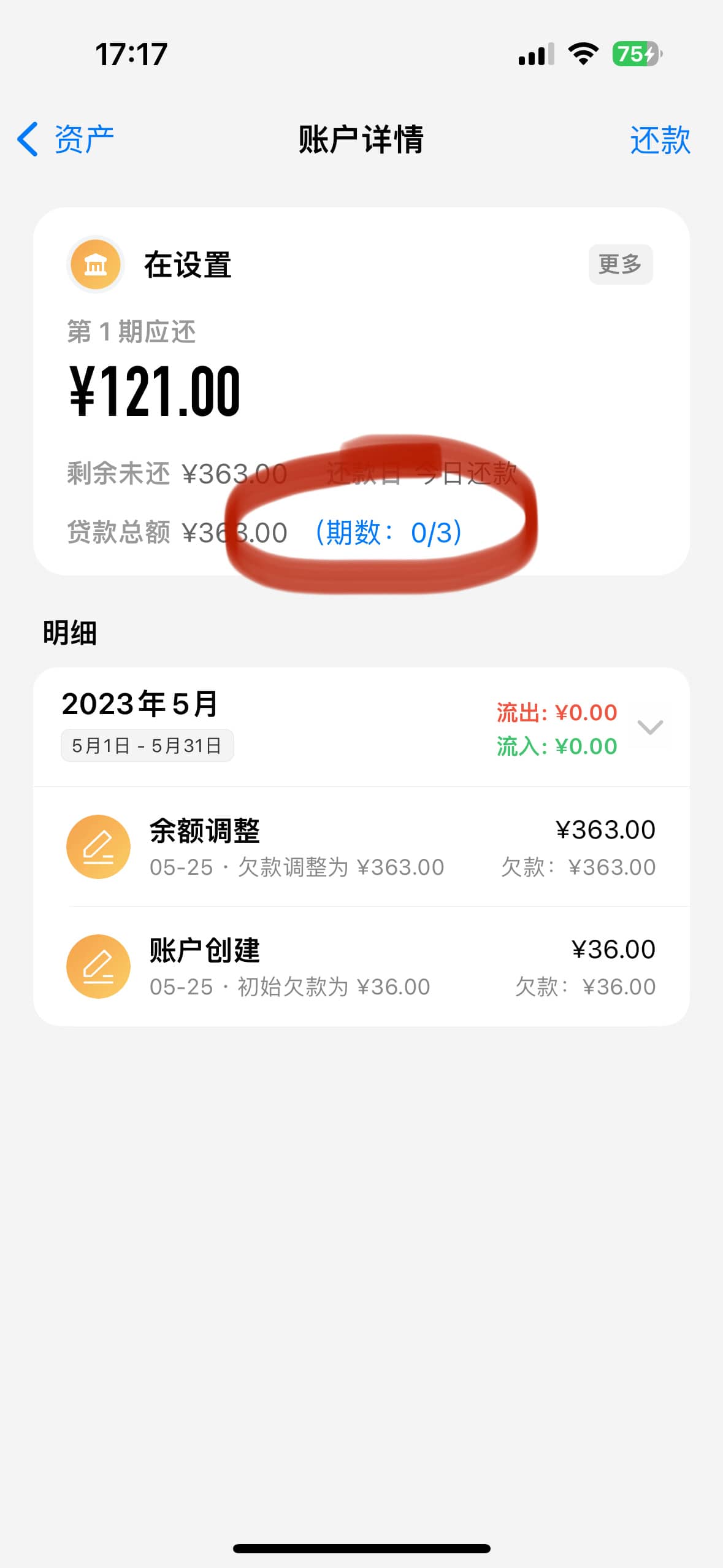

- Number of Repaid Periods: Fill in the actual number of repayment periods up to the current time for this loan.

- First Repayment Date: Fill in the date of the first repayment.

- Repayment Method:

- Equal Installment Principal and Interest

- Equal Installment Principal

- Interest First, Principal Later

- Equal Principal and Interest

- Receiving Account: If filled, the total loan amount will be transferred to this receiving account. This is generally applicable to small loans, not for loans like mortgages where the amount is directly deducted.

# II. Viewing Repayment Schedule

# III. Customizing Loan Period and Amount

If the period and amount cannot be fully matched due to differences in bank rules, you can choose to customize the amount for each period.

When adjusting the custom period amount, ensure that the final adjusted total amount matches the original loan amount.

# IV. LPR Adjustment

In the loan plan interface, you can choose to adjust the loan interest rate. Please note the effective time for selecting the interest rate adjustment.