# Bill Installment

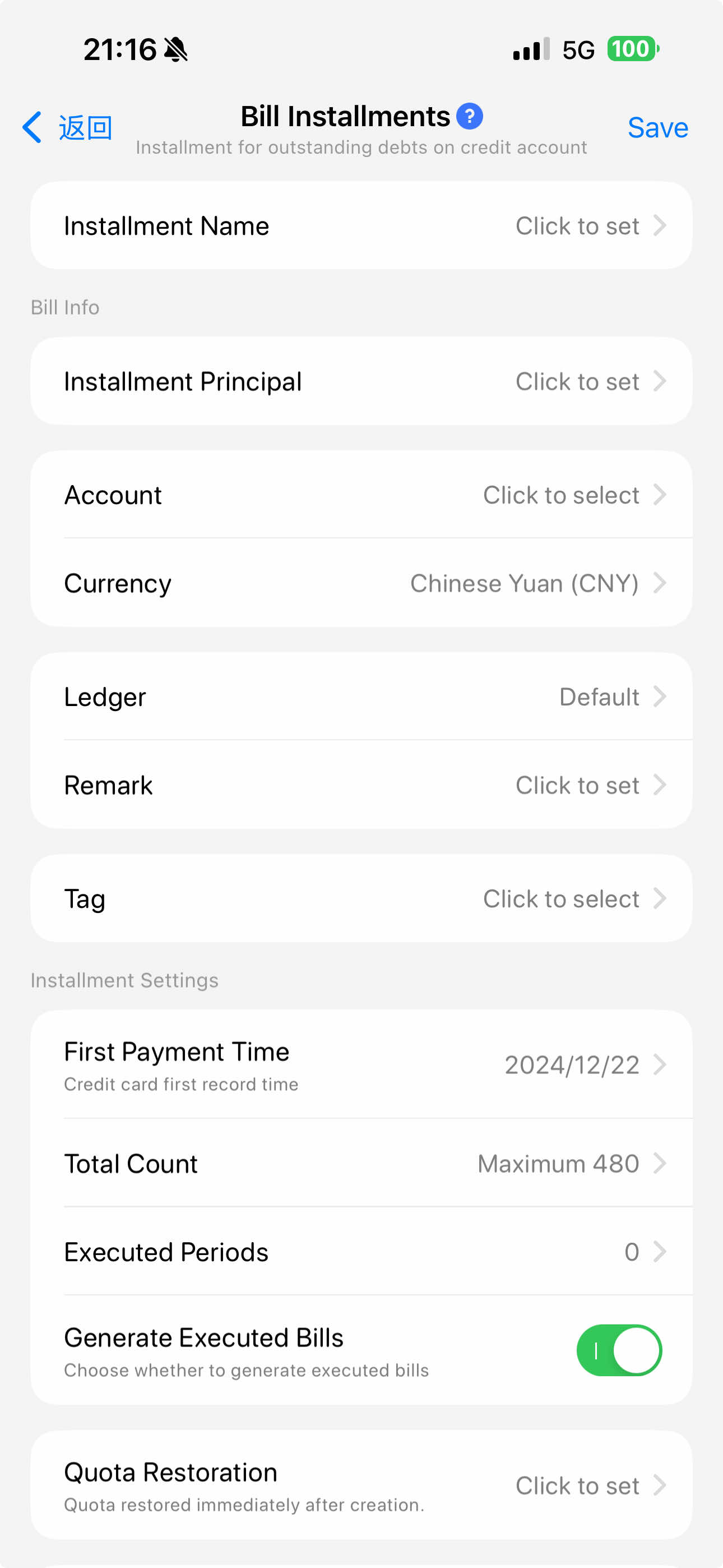

Bill installment is a feature that allows the installment of the monthly repayment amount on a credit account after the billing.

Each month, installment bills are automatically generated at the set billing date. The interest portion is recorded as an expense for the month, while the principal portion, which has already been accounted for during the actual spending, is not included.

# Rules

- If there have been repayments for a specific installment when creating a new one, you can fill in the "Number of Executed Periods." You can also decide whether to generate bills for the executed periods through the "Generate Executed Bills" option.

- Modifying an existing installment task will generate installment bills based on the latest configuration. Existing bills for the installment will be deleted. Please be aware of the "Number of Executed Periods" setting.

# Credit Limit Recovery Feature

The recovered limit cannot exceed the installment amount. It can be set based on the actual amount recovered by the bank. After setting the limit recovery, the credit account will have its limit restored in real-time. The available limit will be occupied after each period's principal and interest are accounted for.

# Method of Including Outstanding Debt

There are two ways in which the installment amount is included in the outstanding debt of the credit account. One is to include it after each period's bill is generated, and the other is to include it all at once when the installment is created.

For example, assuming the installment amount is CNY 1,200, total interest is CNY 12, divided into 12 periods, and each period's amount is CNY 101 (CNY 100 for principal and CNY 1 for interest):

- Installment inclusion: When creating the installment, the principal portion does not contribute to the outstanding debt, reducing the account debt by CNY 1,200. Subsequently, after each period's bill is generated, CNY 100 for principal and CNY 1 for interest are added to the outstanding debt, increasing the account debt by CNY 101. In total: CNY 101 * 12 = CNY 1,212.

- One-time inclusion at creation: When creating the installment, the principal portion continues to contribute to the outstanding debt, maintaining the account debt. Subsequently, after each period's bill is generated, the principal portion does not contribute to the outstanding debt, and CNY 1 for interest is added, increasing the account debt by CNY 1. In total: CNY 1,200 + CNY 1 * 12 = CNY 1,212.

In both methods, the principal and interest are included in the credit account's monthly bill amount after each period's bill is generated.

# Interest Accounting Method

There are two different methods for accounting for installment interest: installment accounting and initial billing.

For example, assuming the total installment interest is CNY 24 and the installment period is 12 periods:

- Installment accounting: CNY 2 installment interest will be generated in the credit account for each period.

- Initial billing: CNY 24 installment interest will be generated in the credit account for the first period.

# Inclusion of Differences After Installment

- Initial period

- Final period

If the installment amount is not divisible evenly, the bank may use rounding methods such as rounding or rounding down to calculate each period's amount, resulting in a difference from the actual installment amount. You can choose to directly accumulate this difference in the initial or final period.

# Installment Repayment

There is no need for separate repayment for installments. After installment bills are generated, they will be included in the credit account's monthly bill amount. Repayment can be done along with other spending amounts after the credit account's monthly billing.